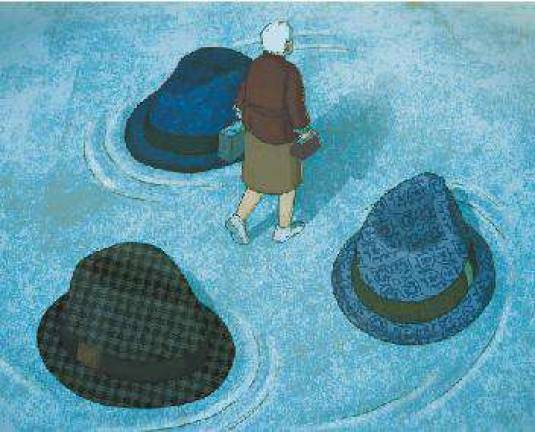

Scamming Seniors: How sharks in the water are targeting older Upper East

New York is a city with a booming elderly population-there are over 3.4 million people over the age of 65 living here. With that aging population come the predators who single out older victims for their nefarious swindles. In an age of small-time Internet scams and big-time Ponzi schemes, everyone is a potential victim of financial crimes, but the elderly are particularly at risk and are often targeted by would-be criminals. Take, for example, the case of an 82-year-old widow living on the Upper East Side. The elderly victim was robbed of $53,000 over a period of several months as 30-year-old Sylvester McCoy stole checks from her home and forged her signature many times over. Or think of the example, perhaps made worse by the victim-perpetrator relationship, of Peter Wilde, who abused the power of attorney he exercised over his aging parents to steal over $1 million from the couple. Or the case of Carolyn Turner, a home aide to an 81-year-old woman living on the Upper West Side, who stole over $25,000 from her employer. Turner swiped the victim's debit cards and forged checks without her permission in order to make credit card and car payments not only for herself but for her adult children as well. These are just a few of the cases that have been prosecuted in the past year, and those only show the crimes that are reported and solved, an outcome not always feasible for elderly victims. "What is common for all these and for so many elder abuse cases is they take place based on existing relationships, whether it's a home health aide, a family member or someone trusted and known to the senior-that's the vulnerability that the defendant takes advantage of," said Manhattan District Attorney Cy Vance in an interview. The Elder Abuse unit in the DA's office specifically investigates and prosecutes cases of financial fraud and other types of elder abuse. They take on roughly 650 cases each year and work to prevent crimes; Vance has spoken at senior centers around the city, hoping to give seniors the tools they need to recognize suspicious situations and the confidence to report crimes when they happen. "There is just an enhanced vulnerability when you get older," Vance said. "There is a reluctance to either know what's going on or, even if you know what's going on, to have the courage to report it because it might be people who are in fact taking care of you." Sometimes, the person is not a family member but someone an older person has come to trust. The Council of Senior Centers and Services (CSC), an umbrella group that represents New York City's senior centers, has collected stories of elder abuse in which city services have been able to intervene and help. One case involved an 80-year-old man living on the Upper West Side who met a 46-year-old woman at a ballroom dancing class and befriended her. When his friend said she needed $38,000 to get her harassing landlord off her back, he willingly loaned it to her, then allowed her to move in when she lost her apartment anyway. Within months, this former friend became a threatening roommate who refused to pay back the loan and routinely threatened to kill her victim. "Over 30 percent of elder abuse cases are perpetrated by family members and friends," said City Council Member Jessica Lappin, who chairs the Council Committee on Aging. "It's important for people to know that there are support services out there for them. If they are being exploited, they should feel comfortable about speaking up." The scams that target older people are often complex and well-oiled. Mortgage scams or deed thefts, in which people trick seniors who are homeowners into signing away their savings or their property, are common. Donna Dougherty, the attorney in charge of legal services at Jewish Association Serving the Aging, said seniors who have their lives, finances and wits about them can still get taken by these types of scams. "I've had people who have lost their entire savings and whatnot, and they were professional people. I had someone who had worked at the Federal Reserve and got taken by a mortgage scam. It was terribly embarrassing to her; she was brilliant with finances," said Dougherty. "You have to understand that it's a crime. They really are looking to give you false information and mislead you; it has nothing to do with intelligence." While those crimes usually require a personal connection to the victim, some criminals chose their targets at random, anonymously. "There are scams going on when a [person pretending to be a] grandchild who lost a wallet calls and needs a ticket home," said Bobbie Sackman, director of public policy at CSC. "They're preying on people's fears that they're alone. Some people might not have their full cognitive abilities, so they just prey on these older folks to get whatever it is they want to get. That's a common one, when they call from another place." Police reports confirm the trend. Officer Ross Dichter, crime analyst for the Upper West Side's 20th Precinct, said that identity theft and online scams are some of the fastest growing crimes, and he routinely comes across reports targeting elderly victims. "Someone approaches an older person on the street, they say, 'Hey I found this envelope with $50,000 in it, go get me $5,000 and we'll split this between the two of us, no one has to know,'" Dichter explained, describing a scheme he said happens all the time. The victim goes to the bank, takes out thousands of dollars in cash and hands it over. The swindler gives up their "share" and quickly disappears, leaving the elderly person with an envelope stuffed with tissue paper and out five grand. Another common scam is through Craigslist, when a scammer answers an ad posted by an older person advertising a service like babysitting. The swindler corresponds and agrees to pay the person in advance, then sends a check for far too much money. The scammer then claims it was a mistake and asks the person to mail back the difference in cash; meanwhile, the check bounces and they become unreachable. Some schemes that target elderly victims aren't necessarily criminal but fall into the category of consumer fraud. Council Member Gale Brewer said that her older constituents are bombarded by mailings soliciting information from them and that they often get confused about what is legitimate and what's not. She has also heard of scams that collect low monthly payments in exchange for supposed ownership of land or property, which turns out to be for nothing-send in $10 a month and get a piece of land in Florida, for instance-that operate just this side of legally through complicated fine print disclaimers. "They can make $80 million a week off of these scams. They're not small operations," Brewer said. "They have the best attorneys in the U.S. and they usually stay just above the law. They only prey on the elderly. You can't quite believe that people would actually do these things but they do." Advocates say there are ways for seniors to protect themselves and for loved ones to be on the lookout for signs of financial exploitation. The DA's office has worked to educate major banks to be aware of unusual transactions in their older clients' accounts, and anyone helping an elderly relative should be alert for changes in spending or strange bills being delivered. Dougherty cautions that anyone who tries to isolate elderly people and not allow them to seek outside advice should not be trusted. "Seniors, like everybody else, need to be vigilant without necessarily being fearful," Vance said. "Being vigilant may be something as simple as checking your credit card statement, checking your bank statements. When someone calls you on the phone and it sounds too good to be true, it probably is."